Our metallurgical operations process complex concentrates and other materials from our own mines, from those of our subsidiaries and from outside shippers, to produce refined metals with high quality and purity, certified for international trade, which are used by a wide range of industries in the various countries where our clients are located.

The Metals Division is composed by a metallurgical complex located in Torreón, Coahuila, which produces refined gold, silver, lead and zinc; the Aleazin plant in Ramos Arizpe, Coahuila, which manufactures specialty zinc alloys according to our clients’ needs; and the Bermejillo plant in Durango, where byproducts from our smelter are processed and copper sulfate, zinc sulfate and antimony trioxide are produced. Together, these plants comprise the company Metalúrgica Met-Mex Peñoles (Met-Mex), one of the largest and most important metallurgical complexes in the world.

Met-Mex is one of the top two producers of refined silver in the world, the leading producer of primary refined gold and lead in Latin America, and the world’s eleventh largest producer of refined zinc.

invested in metallurgical operations to improve processes and conclude the Silver II Recovery project.

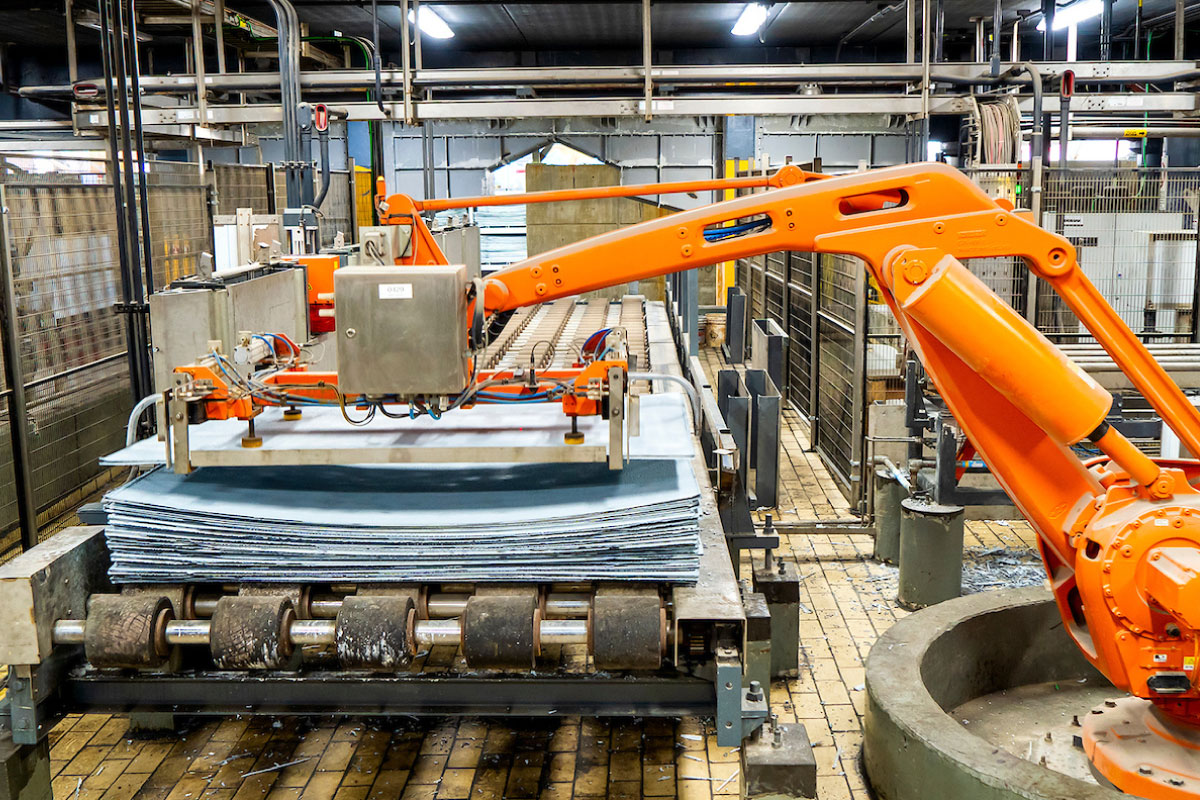

Met-Mex has two primary circuits:

The lead-silver circuit, comprising the lead smelter, where lead-silver concentrates are processed to produce lead bullion, and the lead-silver refinery, which receives both the lead bullion and doré bars, precipitates and other materials rich in metal content to produce refined gold, silver and lead.

LEAD-SILVER CIRCUIT

Annual production capacity

kt lead

Moz silver

Moz gold

The zinc circuit is fed with zinc concentrates, which are treated by an electrolytic process to produce refined zinc in different qualities and presentations. With an annual production capacity of 350,000 metric tons, this circuit comprises two plants: the old plant (Plant 1), which uses concentrate roasting, and a new plant (Plant 2) which started up operations in 2019 and replaces roasting with leaching, thus taking advantage of some of the sulfuric acid produced as a byproduct in Plant 1.

ZINC CIRCUIT

Actions in connection with COVID-19

To mitigate the impact of the COVID-19 pandemic, avoid the spread of the virus and protect the health of our employees, our metallurgical operations strictly followed internal protocols and the guidelines established by the IMSS and the STPS. We obtained authorization to work according to the Sanitary Safety Protocol established by government agencies, and the IMSS awarded the company its Sanitary Safety distinction in recognition of our compliance with guidelines to control contagion.

We assigned administrative personnel and those with specific vulnerabilities to work from home, and set up access checkpoints at all our facilities, with strict monitoring and hygiene measures to ensure a safe return of employees during staggered work hours, in close communication with the company’s Crisis Committee.

We also carried out an intensive program of support for hospitals, healthcare centers and communities, donating 63,881 medical supplies and materials and investing Ps. 3.4 million, which benefited more than 135,000 people. We offered educational activities, community center workshops and sports, and Pro-Empleo programs through virtual media, which we also used for notifying employees and communities of our sanitary measures.

Peñoles donated 30 Philips model E30 respirators to the government of Coahuila in order to strengthen the state’s hospital infrastructure.

Production and performance

The production of the leading refined metals and their change from the previous year was as follows:

| 2020 | 2019 | % chge. | |

|---|---|---|---|

| Gold (koz) | 957 | 1,113 | -14.0 |

| Silver (koz) | 70,634 | 72,385 | -2.4 |

| Lead (t) | 111,538 | 118,889 | -6.2 |

| Zinc (t) | 260,943 | 283,611 | -8.0 |

Our metal business faced tremendous challenges during the pandemic, chiefly the protection of our people’s health by keeping all vulnerable personnel at home according to the recommendations of the authorities; but also the temporary suspension of the supply of concentrates and materials from some of our shippers; a steep drop in the prices of industrial and precious metals in the first few months of the year, although they recovered in the second half; and a downturn in demand for our products on both domestic and international markets. All of this affected production volume and sales.

As for our economic performance, treatment charges—which are pegged to international standards—recovered for lead and zinc concentrates, benefiting revenues in the metal business and offsetting the impact of the drop in treatment volume. This factor, together with the savings measures we took, favored production costs in the lead-silver business. In the zinc business, however, costs rose because of operating adjustments at the new concentrate leaching plant, particularly the electrolytic process, and also because of a jump in overtime and electricity costs. Even so, the operating margin for the metal division as a whole improved compared to the previous year.

LEAD-SILVER CIRCUIT

| Volume received (t) | 2020 | 2019 | % chge. |

|---|---|---|---|

| Concentrates (Smelter) | 277,262 | 292,987 | -5.4 |

| Direct materials (Refinery) | 1,211 | 2,367 | -48.9 |

| Total raw materials | 278,473 | 295,354 | -5.7 |

| Peñoles* | 199,855 | 202,352 | -1.2 |

| % of total | 71.8 | 68.5 | - |

| Outside shippers | 78,618 | 93,002 | -15.5 |

| % of total | 28.2 | 31.5 | - |

Share in raw material content

| Gold | Silver | Lead | |

|---|---|---|---|

| Peñoles* | 79.2% | 67.9% | 63.8% |

| Outside shippers | 20.8% | 32.1% | 36.2% |

*Includes Penoles and Fresnillo plc mines.

The lead smelter treated 324,000 metric tons of concentrates during the year, 2.5% less than the year before. The acquisition of concentrates with higher lead grades from outside shippers improved the mixtures’ quality, helped to control impurities and promoted a better performance in the sintering area. The smelting furnaces were kept in continuous operation and measures were taken to reduce programmed shutdowns with satisfactory results. An optimal mix of coke was fed into the furnaces, helping lower costs; and byproducts were processed to recover silver and lead values. The production of lead bullion declined by 4.3% from the previous fiscal year, to 134,522 metric tons.

The lead-silver refinery received a lower amount of dorés from Herradura and Noche Buena, although the latter made up for it with inputs of activated carbon. This, combined with the reduction in purchases of rich materials from outside parties, affected gold and silver production. Additionally, the lower volume of bullion treated meant a lower volume of refined gold, silver and lead produced than in 2019. Efficiency projects were undertaken to reduce consumption of zinc and calcium-magnesium alloy, both of which are used in the lead refinery. This resulted in savings of US$ 1.3 million, and an increase in the useful life of the kettles by 280 metric tons, with a benefit of US$ 0.7 million.

Revenues per metric ton treated in the lead-silver business grew 11.2% on average compared to the previous year. Unit production costs were lower (-0.6%), primarly due to more efficient coke consumption for the furnaces and lower costs for maintenance and repair.

Our investments during the year totaled US$ 50.8 million, and were focused mainly on replacing critical equipment, implementing technological updates, improving environmental performance and reducing risks to our employees.

ZINC CIRCUIT

| 2020 | 2019 | % chge. | |

|---|---|---|---|

| Concentrates received (t) | 699,306 | 756,524 | -7.6 |

| Peñoles* | 510,312 | 529,436 | -3.6 |

| % of total | 73.0 | 70.0 | - |

| Outside shippers | 188,994 | 227,088 | -16.8 |

| % of total | 27.0 | 30.0 | - |

Share of content in concentrates

| Zinc | |

|---|---|

| Peñoles* | 72.3% |

| Outside shippers | 27.7% |

* Includes Penoles and Fresnillo plc mines.

In the zinc business, we succeeded in stabilizing the processes and interaction of the two plants, which work by roasting and leaching, respectively.

We also successfully interconnected the Silver II recovery project, whose purpose is to increase the treatment of zinc concentrates with high silver values through a process involving pure jarosite in leaching. This recovery will add between 3 and 3.5 million ounces of silver to annual production.

Treatment volume declined by 7.2.% from 2019, totaling 582,000 metric tons, while average revenues per metric ton treated grew 24.2%, favored by better treatment charges, free metals and lead-silver cements that were sent to the lead smelter for refining. This benefit was offset by an average 28.0% increase in the unit cost of production due to lower treatment volume and higher electrical energy costs, depreciation, an increase in overtime payments, maintenance and operating materials.

During the year, the company invested US$ 50.8 million, most notably in completing the Silver II recovery project, as well as other investments in support systems and replacement of critical equipment, which enabled us to ensure operating continuity and improve the efficiency of the zinc circuit.

Sales and business development

We obtained Good Delivery recertification for the gold and silver we produce from the London Bullion Market Association (LBMA), which allows us to continue selling our products in international markets. This certification provides an international guarantee of Peñoles’ ethical performance in the precious metals sales process.

Also, for the third year in a row, we received Responsible Silver & Gold certification from the LBMA, in recognition of the conflict-free supply chain for our refined products.

During the pandemic, some of our clients were cautious and reduced their demand for our products. Despite an uncertain market and rising prices, we were able to meet our gold and silver delivery commitments on time, adjusting to the changing needs of our clients and placing all of our production.

Our main gold client decided to withdraw from the market, but we were able to develop new consumers on the international market.

In the silver export market to Japan, we reinforced processes and protocols to comply with freight safety requirements and other specifications from our clients, who supply the solar cell industry in Japan and China.

We remain a key strategic supplier to domestic clients in refined lead, helping them to develop new alloys for high-performance batteries as we improve specifications according to their requirements. We placed refined lead on alternate markets to counter the contraction of our own primary market due to the contingency.

We obtained good results for products aimed at the mining industry, despite the difficulties caused by the public health crisis, particularly zinc sulfate, where we achieved record sales.

In the zinc market, demand dropped sharply in the first half of the year, but we were still able to place our products on alternative export markets. In 2020 the value of our zinc sales—our third most important product after gold and silver—declined by 13.1% from the previous year, because of lower sales volume and prices. The domestic market accounted for 30.2% of sales, while the other 69.8% was sold in export markets—compared to a ratio of 31.6%/68.4%, respectively, in 2019.

in zinc sales, represented 13.3% of sales in 2020.