In 2020 we carried out 61,911 meters of diamond drilling at Peñoles-operated mines, in order to ascertain proven blocks of reserves and generate mineral resources to ensure the operating continuity of our mining units.

A calculation of reserves of the mining units was conducted in January 2020 in order to support budget and operating plans for the year. To enhance the certainty of these estimates, mineral reserves and resources were calculated according to the International Code of the Joint Ore Reserves Committee (JORC version 2012) using MRO software, which optimizes and offers greater precision in locating economic blocks of minable reserves.

The calculation applied Peñoles’ long term price projections, more conservative than those assumed in the 2019 reserves calculation: gold US$ 1,250.00/ounce (-7.4%), silver US$ 17.00/ounce (-8.1%), lead US¢ 95.00/pound (-9.5%), zinc US$ 1.10/pound and copper US$ 3.10/pound. The cut-off grade increased by 8.3% on average, which, combined with assumptions of lower prices, higher production costs and treatment charges, resulted in estimated resources and reserves equivalent to 34 and 13 years of mine life, respectively, at the projected pace of production in five years—compared to 38 and 17 that were calculated in the 2019 assessment.

Excluding the Bismark, Madero and Milpillas units, mine life is 15 years of reserves and 39 years of resources. A table showing the calculation assumptions and breakdown of reserves appears on page 56 of this report.

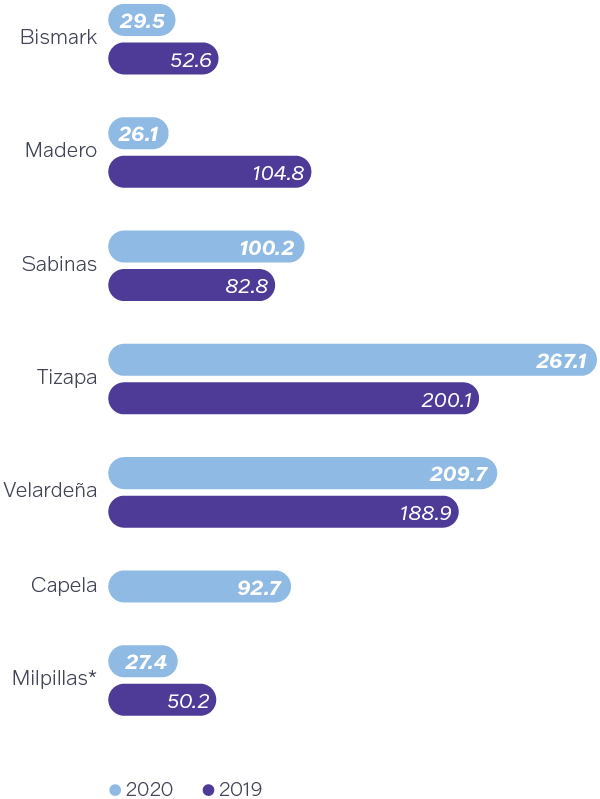

With modifications in the economic parameters, the resource grades at Tizapa increased and some zones were lost in the Western Block, which were offset by the tonnage from the Central and Eastern blocks due to interpretation and good grades at the current cuts and drill sites. In Velardeña’s case, there was a reduction in reserves, mainly at Antares Norte, because of the elimination of surrounding non-minable land and extraction from the dike in longhole stopes. At Sabinas, the cut-off grade increased by more than the average, while at Capela adjustments were made to the geological models to correspond to the real timeline of the mine opening. In 2021, exploration resources will be added from sampling the works and exploratory drilling.

Metal content in Peñoles’ proven and probable reserves, including the Capela mine and the subsidiary Fresnillo plc, along with their change from 2019 to 2020, are as follows:

Consolidated reserves

| 2020 | 2019 | % chge. | |

|---|---|---|---|

| Gold (koz) | 9,757 | 10,303 | -5.3 |

| Silver (koz) | 716,541 | 700,231 | 2.3 |

| Lead (kt) | 1,756 | 1,724 | 1.9 |

| Zinc (kt) | 5,718 | 6,562 | -12.9 |

| Copper (kt) | 367 | 533 | -31.2 |

* Includes 100% of the reserves from the Juanicipio unit (under development).

Estimates of resources and reserves are periodically updated, according to the methodology and standards recognized in the mining industry.